Expert In Wills And Probate Matters

With a twelve-year establishment, we are industry leaders trusted by numerous clients.

Fixed And Transparent Fees

Our fees are transparent, equitable, and often feature fixed rates for various services we provide.

Approachable And Friendly

Our representatives take pride in creating a comfortable environment for clients by offering flexible meeting locations and using tactful language.

Wills & Power Of Attorney

Wills

Your Will is one of the most important documents that you will ever make, it gives direction to what happens when you die. You need to consider what should go into making a Will.

Islamic Wills

In countries where intestate succession laws differ from Islamic law, such as England and Wales, it becomes essential to write a Will to ensure your estate is distributed according to Islamic principles.

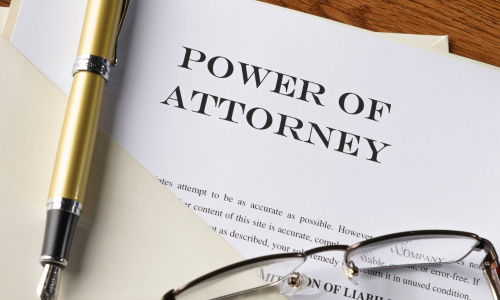

Power of Attorney

A Lasting Power of Attorney (LPA) is a crucial part of later life planning, alongside a Will. It provides protection by coming into effect if you lose the capacity to make decisions for yourself due to conditions like a stroke or dementia.

Probate

Probate is the overall legal term used, after someone has died, where his or her estate (assets and debts) is administered, assets are distributed to beneficiaries and debts and any taxes are paid. In simple terms, someone needs to have the legal power and authority to deal with the deceased’s legal affairs and carry out the deceased’s wishes.

Where a will has been left, executors are normally named to fulfil this role. In order for executors to be able to complete the legal processes needed, they will need to apply for a grant of probate and in some cases, need to pay Inheritance tax out of the estate.

Trust

Trusts can be one of the most effective ways to save or mitigate tax, but many people assume they’re too complex or costly to explore. In reality, a trust is a simple legal mechanism that sets aside assets for a specific purpose.

If you own a business, have a vulnerable child or relative, a pension, life insurance, or are in a second relationship, speaking with a trust advisor could uncover significant tax savings and other benefits you may not be aware of.

If you own a business, have a vulnerable child or relative, a pension, life insurance, or are in a second relationship, speaking with a trust advisor could uncover significant tax savings and other benefits you may not be aware of.

Estate Planning

Probate is the overall legal term used, after someone has died, where his or her estate (assets and debts) is administered, assets are distributed to beneficiaries and debts and any taxes are paid. In simple terms, someone needs to have the legal power and authority to deal with the deceased’s legal affairs and carry out the deceased’s wishes.

Where a will has been left, executors are normally named to fulfil this role. In order for executors to be able to complete the legal processes needed, they will need to apply for a grant of probate and in some cases, need to pay Inheritance tax out of the estate.